19 May 2022

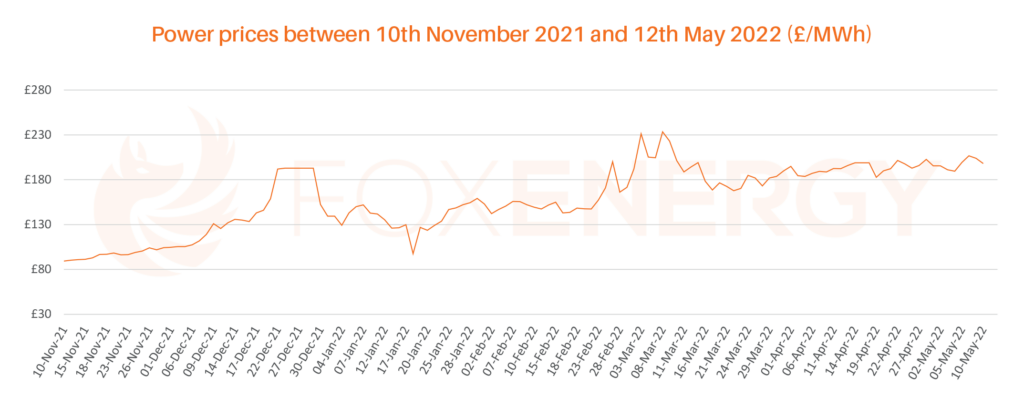

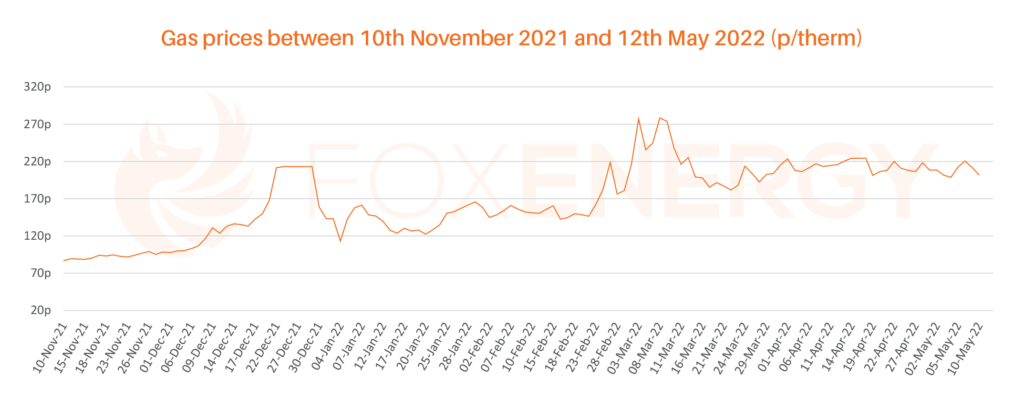

High volatility remains a prominent feature in an illiquid energy market as oil and gas prices yoyo in the wake of supply and demand concerns. Respite in the markets has seen the gas markets fall to a 4-month low (at the time of writing) as the UK’s capacity, in the short term at least, appears adequate due to receiving an influx of LNG shipments, and ‘winter delivery levels’ arriving via the Norwegian shelf pipeline. Electric markets are at a 2-month low, coupled with higher-than-average seasonal temperatures leading to lower than the expected normal use for this time of year, which is common for this time of year as we enter the traditionally cheaper summer period.

So why are these small gimmers of positivity not seeing a reflective fall in consumer bills and contract offers? Volatility remains as the current stock levels are not reflective of the true stock levels required for the coming winter period; traditionally suppliers restock the UK’s limited storage during the summer lower demand periods in readiness for winter.

Nervousness is rife across Europe given the ongoing conflict in the Ukraine, with all EU countries rushing to store vast levels of gas given the uncertainty of the future supply of Russian gas and the potential move to future payments only being accepted in Rubles. With the desire of the UK and the EU to move away from dependency on Russian gas, alternate suppliers will be looking to potentially profiteer on their stocks, knowing that there are limited alternatives available and with various ‘defense’ treaties being agreed between non-NATO countries and the UK and EU, the markets are reflective of the potential escalation this could cause with Russia – indeed the day that the UK agreed to provide military support to Finland and Sweden in the event of an attack, the markets increased by nearly 22%!

Given all of this instability it is highly unlikely that the recent fall in wholesale costs will be seen by businesses in the near future and many analysts believe that the markets will return to the highs seen over the past few months as we enter the autumn/winter periods as demand soars, with Ofgem already warning consumers to expect further increases to the domestic price cap from October – and let’s not forget that businesses have no such price cap in place to protect them as many businesses are currently finding out to their cost with enormous increases in utility costs as existing contracts end and suppliers cease to trade, forcing them to market now.

In other troubling news, various suppliers have begun to enforce take of pay clauses on industrial and commercial businesses for exceeding their contracted energy volumes (most (but not all) suppliers have a circa + or – 20% tolerance on the contracted gas/electric in their terms and conditions), which prior to 2022 was rarely seen or enforced by suppliers. This enables the supplier to charge the business user the current market rate for usage deemed outside the tolerance levels, rather than at their fixed contracted rate as the supplier argues that they only purchased the contracted volume of gas at the time of the agreement and therefore the excess usage and subsequent supplier losses were not accounted for and are therefore passed on the client. At the point of an agreement, contracts are based and secured against the previous 12 months industry held consumption data; this is highly unfair, given the past 12 months data would not have accounted for Covid-19 lockdowns and was therefore unreflective of true use. It is also a clause that is always in the suppliers favour as any under usage would enable them to resell this gas for a huge profit in the current marketplace, which they do not share with the contracted business! There is little to prevent suppliers from enforcing this clause, but it can be fought and challenged to help limit the additional costs and we would advise you to engage with your supplier or consultant for assistance.

The 1st of April saw the annual review of industry and network capacity and transportation costs and charges which are generally covered in the daily standing charge element of energy contracts. Huge increases in cost to the running and maintenance of the networks, coupled with Ofgem’s SOLR (Supplier of Last Resort) costs being passed through to the remaining suppliers has seen many suppliers such as Avanti Gas in turn, passing these additional costs onto their clients with many seeing the cost of the daily standing charge increase by circa 150%! The SOLR scheme is part of a supplier’s energy license conditions, and in the event of failed suppliers, the remaining suppliers must foot the bill for the losses and payments due to the network from the defunct suppliers. Again, virtually all suppliers can pass these costs on to their customers under their terms and conditions, and as they are in effect ‘new Government & industry charges’ (although many suppliers do try to absorb them, rather than pass them on to customers). Many suppliers are also using the force majeure clause seen is all contracts to pass this additional charge on to consumers. Avanti Gas will not be the last to pass these costs on and the general feeling in the industry that given the losses being faced by suppliers in the wholesale markets, they will simply recoup these costs and losses from consumers, and this may become a seasonal ‘norm’.

In other industry news this month:

Nearly £20bn in government funding for energy storage is needed by 2030 – Almost 10% of grid capacity will be provided by battery storage by 2030, according to a new report. Tom Edwards, a Senior Modeller at Cornwall Insight, said: “The shift in power markets will significantly alter the operation and development of the power generation mix, making prices more volatile and more exposed to weather and demand patterns. This will necessitate the development of backup technologies to carry the system through when the wind does not blow, and the sun does not shine.”

Ofgem: “Inability to afford rising bills, a matter of life and death” – It is now extremely likely that Householders in England, Wales and Scotland will be hit by further increases in their energy bills in October. It is predicted that the Autumn default tariff cap will be around £2,600. Ofgem Chief Executive Jonathan Brearley has said prices in the energy market remain “highly volatile. For some, not being able to afford rising energy bills is literally a matter of life and death.”

Ofgem enables National Grid to make early payment of interconnector revenues, helping to reduce household bills – Ofgem has approved National Grid’s request to make early payments to consumers of £200 million over the next two years as part of the regulatory regime for electricity interconnectors. Ofgem’s cap and floor regime sets a yearly maximum (cap) and minimum (floor) level for the revenues that the interconnector licensees can earn over a 25-year period. Usually, revenues generated by the interconnector are compared against the cap and floor levels over five-year periods. Top-up payments are made to the interconnector licensee if revenues are lower than the floor; and similarly, the licensee pays revenues in excess of the cap to consumers. Ofgem’s approval enables National Grid to make payments of above cap revenues significantly earlier than originally planned, which will contribute to reducing consumer energy costs over the next two years. National Grid is now working with Ofgem to explore how to ensure the early payments can have the most impact for consumers.

For help and advice and to find out how Fox Energy can support and assist your business in these turbulent times, get in touch by calling 01233 884510 or email info@foxenergy.co.uk.